Horizon alternatives

This guide gives IT and business leaders a practical roadmap for replacing Horizon, covering the leading VDI and DaaS alternatives and outlining the key steps for evaluation, comparison, and a successful migration.

Beyond a conference — NerdioCon 2026: Learning, networking & unforgettable moments.

Save your spot

This guide gives IT and business leaders a practical roadmap for replacing Horizon, covering the leading VDI and DaaS alternatives and outlining the key steps for evaluation, comparison, and a successful migration.

Carisa Stringer | October 27, 2025

The 2023 acquisition of VMware by Broadcom introduced significant changes to licensing, product bundling, and support, prompting a widespread reassessment of end-user computing (EUC) strategies across the industry.

Understanding the current landscape of alternatives is now critical for controlling costs, improving operational efficiency, and delivering a superior user experience.

Disclaimer: Content referencing Omnissa products is based on public information from the Omnissa website, current as of the last article update. For the latest product details and further inquiries, please consult the official Omnissa website.

Many long-time VMware customers are exploring other platforms due to shifts in strategy, pricing, and support that may no longer align with their business or technical goals.

According to a recent Gartner report, The Future of VMware’s EUC Products, concerns about licensing changes, reduced support, and a possible slowdown in innovation are prompting businesses to explore alternatives to VMware Horizon (now Omnissa). This evaluation is driven by a combination of immediate pain points and long-term strategic objectives for a more flexible and cloud-integrated future.

A structured evaluation ensures you select a platform that meets not only your technical requirements but also your business and financial goals. To do this effectively, you should identify direct and indirect dependencies on your current Horizon and Workspace ONE environment and conduct a thorough risk analysis of potential product and pricing changes.

A complete comparison requires looking beyond feature lists to consider the total cost of ownership, user experience, and long-term strategic alignment. A key technical consideration is the underlying desktop virtualization technology, which directly impacts the scalability, performance, and overall efficiency of the VDI or DaaS environment.

You can also examine Gartner’s peer reviews for invaluable, real-world perspectives on how different VDI and DaaS solutions perform in various enterprise environments.

To simplify your evaluation, the following tables use Horizon as a baseline and break down the leading enterprise-grade alternatives. While each is a mature platform, the best choice will depend on your specific goals for cloud integration, cost, and technical capabilities.

| Omnissa Horizon (Baseline) | Microsoft AVD | Windows 365 | Citrix DaaS | Amazon WorkSpaces | |

|---|---|---|---|---|---|

| Delivery Model | VDI/DaaS (Hybrid/Multi-Cloud) | DaaS (Control Plane in Azure) | SaaS (Cloud PC) | DaaS (Hybrid/Multi-Cloud) | DaaS (in AWS) |

| Stand-Out Strengths | Mature, feature-rich platform, strong hybrid cloud management, robust display protocol. | Deep integration with Microsoft 365, multi-session OS support, flexible pay-as-you-go pricing. | Simplicity, predictable fixed pricing, dedicated persistent desktops. | Mature protocol (HDX), robust hybrid management, broad feature set. | Strong integration with the AWS ecosystem, simple pricing. |

| Typical Limitations | Complex to manage, uncertainty due to acquisition, subscription-only model. | Requires Azure expertise, variable infrastructure costs. | Less flexibility than AVD, primarily for persistent desktops. | Higher licensing cost, can be complex to configure. | Limited to the AWS cloud, fewer enterprise management features. |

| Best-Fit Scenarios | Existing VMware customers with heavy on-premises investments and complex, hybrid VDI needs. | Organizations standardized on Microsoft 365 seeking maximum flexibility and cost control for pooled and personal desktops. | Businesses wanting simple, predictable pricing for dedicated, persistent Cloud PCs for individual users. | Enterprises with complex, hybrid environments or those needing advanced protocol features. | Companies heavily invested in AWS seeking a straightforward DaaS solution. |

While the summary table provides a high-level overview, the following detailed comparison allows your technical team to analyze specific capabilities. The table below directly compares how each alternative handles critical operational features, from display protocols and multi-session OS support to hybrid management and security integration.

| Omnissa Horizon (Baseline) | Microsoft AVD | Windows 365 | Citrix DaaS | Amazon WorkSpaces | |

|---|---|---|---|---|---|

| Primary Display Protocol | Blast Extreme, PCoIP | RDP | RDP | HDX | PCoIP, WSP (DCV) |

| Multi-Session OS Support | Windows Server multi-session; (Windows 10/11 single-session only) | Yes (Windows 10/11 Ent) | No | Yes (Windows Server/10/11) | No |

| Hybrid/Multi-Cloud Control Plane | Yes | Primarily Azure, some hybrid via Azure Stack HCI | No | Yes | No |

| GPU/Graphics Instance Support | Yes (NVIDIA vGPU) | Yes (N-series VMs) | Yes | Yes (NVIDIA vGPU) | Yes (Graphics.g4dn) |

| Identity & MFA Options | Active Directory, Entra ID, Workspace ONE Access | Entra ID, AD, Hybrid | Entra ID | Entra ID, AD, Okta, etc. | AD, RADIUS |

| Built-in Power Management/Autoscaling | Yes (in Horizon Cloud) | Yes (Scaling Plans) | N/A (Fixed Cost) | Yes (Autoscale) | Yes (AutoStop) |

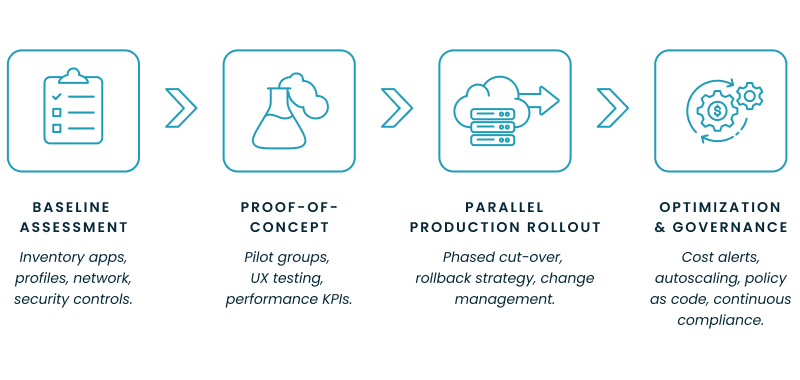

Migrating from an established VDI platform is a significant undertaking that requires careful planning and execution. A phased approach ensures minimal disruption to users and allows your team to validate performance and functionality at each stage.

This step-by-step wizard tool gives you the total cost of ownership for AVD in your organization.

For organizations choosing to migrate from Horizon to the Microsoft ecosystem, third-party management platforms can dramatically simplify the process. These tools add a layer of automation and optimization on top of the native Azure portal, reducing administrative overhead and controlling costs.

See this demo to learn how you can optimize processes, improve security, increase reliability, and save up to 70% on Microsoft Azure costs.6

See how you can optimize processes, improve security, increase reliability, and save up to 70% on Microsoft Azure costs.

Yes, it’s the same product line, rebranded. Omnissa is the new independent company that now publishes and develops the Horizon product family formerly marketed under the VMware name; as part of that change the Horizon product (including the client) has been rebranded to Omnissa Horizon. Note that branding, download URLs and documentation are being updated to Omnissa assets as part of the transition.

No, it’s not discontinued; it has been rebranded and moved to a new company (Omnissa). The Horizon product line continues to be developed and supported, but under the Omnissa name following the divestiture of Broadcom’s End-User Computing (EUC) division to KKR. Operational things customers rely on (support portals, download endpoints, documentation links) are moving to Omnissa-managed locations. Some legacy URLs and endpoints have scheduled removal dates — check Omnissa notices for exact cutover dates.

The Horizon client software itself is available for free download (now as Omnissa Horizon Client), but running a Horizon desktop or app requires a licensed, server-side deployment. In other words: the client is free-to-install, but the server/product environment that delivers virtual desktops/apps is a licensed product.

Major competitors are Microsoft (Azure Virtual Desktop & Windows 365), Citrix DaaS, and AWS (Amazon WorkSpaces / WorkSpaces Web). These are the principal alternatives organizations evaluate for virtual desktops, application delivery, and DaaS.

Customer story

Carisa Stringer

Head of Product Marketing

Carisa Stringer is the Head of Product Marketing at Nerdio, where she leads the strategy and execution of go-to-market plans for the company’s enterprise and managed service provider solutions. She joined Nerdio in 2025, bringing 20+ years of experience in end user computing, desktops-as-a-service, and Microsoft technologies. Prior to her current role, Carisa held key product marketing positions at Citrix and Anthology, where she contributed to innovative go-to-market initiatives. Her career reflects a strong track record in driving growth and adoption in the enterprise technology sector. Carisa holds a Bachelor of Science in Industrial Engineering from the Georgia Institute of Technology.