How to create Azure offers & packages

Why package Azure?

You made the decision to transform your MSP practice by leveraging the latest cloud technologies and you decided that Azure and Office 365 are your preferred cloud platforms. You became a CSP Reseller and learned all about Azure terminology, elements, and hierarchy. Your technical team has familiarized themselves with the fundamentals of Azure’s compute, storage, and networking resources and completed a pilot using Nerdio Manager for MSP.

Perhaps you even got trained and certified with the AZ-100 Microsoft Azure exam. You and your sales team learned how to make money in Azure by optimizing your margin and started using Nerdio’s Azure Cost Estimator to model a handful of what-if scenarios for a few customers.

You are now at the point where you want to put this foundational knowledge together to create standardized Azure offers that you can package and take to your existing and new customers and start scaling your Azure practice.

Sure, you could treat every engagement as a custom project with a specialized quote and proposal. However, with Azure’s increased complexity over traditional IT systems, this approach will require your busiest Azure experts to be involved in architecting each customer environment just to put out a quote! Your salespeople will struggle with this approach unless they themselves are super technical and deep in Azure, and ultimately the cost of quoting each Azure engagement will be very high.

How do you address this business agility challenge? In a word: Productization.

Azure productization

Office 365 is a perfect example of brilliant productization. Microsoft took technically complex products such as Exchange, SharePoint, and the former Lync, then packaged them together for different audiences (i.e., Business Premium for SMB, E3 for Enterprise) — and it took off like wildfire!

Why? Because it became incredibly easy to transact; just buy a monthly subscription and all software and hosting is included. It also became easy for salespeople and customers to understand.

For example, if you work in an enterprise and need Office and Exchange, then E3 is the answer for you. If you own a small business and don’t need all the Office applications but do need a mailbox and the ability to share files with co-workers, then the perfect solution is Office Business Essentials.

This shifts the conversation between salespeople and customers from talking about CPUs, GBs of RAM, and bandwidth to talking about the right “package” for the needs of the business. The technical complexity doesn’t fully disappear from the process. It just moves out of the sales process and over to on-boarding and implementation where it belongs.

Most MSPs don’t win 100% of the proposals they put out, so why spend precious resources dealing with the technical complexity of architecting a solution if it won’t result in a won deal?

Not only does productization reduce the effort during the pre-sale process, it also reduces the sales cycle and increases agility. Having logical, well-structured offers (i.e. packages) simplifies the conversation between salespeople and prospects. It also becomes easier for customers to understand what they are buying and why, without them having to dive into the nuts and bolts of the product. Productization also opens the door to the creation of collateral and web site offers that prospects can review and absorb before even engaging with your sales team.

Compare the buying experience of someone going to an MSP’s website where the CTA (call to action) throughout is, “Contact us for a custom quote” versus someone who goes to the Office 365 website with the various packages listed side-by-side with prices, features, and technical details all in one place. By the time a prospect picks up the phone to contact a vendor selling productized solutions, they already have a good sense of what the products do, who they are designed for, and most likely which product they need.

With a clearly marked price, the MSP can shortcut the entire budgeting discussion and instead focus on pre-qualified prospects who won’t have sticker shock when they hear the price for the first time.

Azure differentiation

Productizing sounds compelling—but there is more! Let’s look at differentiation. Organizations have a difficult time distinguishing between MSPs and their services. Each website and proposal talk about similar qualifications, expertise, technology, and quality of service. A non-technical buyer struggles to differentiate between one MSP and another.

MSPs have an opportunity to invest the effort to understand their buyers and create differentiated offers. This can make it easier for their buyers to understand what the MSP does and how they compare to the competition. Sometimes it can be something as simple as combining the same set of services in a clearer way and in a bundle the buyer understands.

Finally, let’s not forget the reason why you’re in business – to make money. What impact does productization have on margin? It is well known that selling products and services as individual line items, especially when they have publicly available list prices, leads to significant price pressure particularly at closing. Customers look at line items and try to understand each one individually, often comparing prices online.

This squeezes MSP margins significantly. With productized offers, there is significantly less price pressure as there is no way to price shop a productized package due to its uniqueness. MSPs can now bundle in valuable services like a help desk that may not have an immediate marginal cost to deliver, but increases the value of the bundle.

Differentiated, packaged offers lead to significantly higher margins as compared to proposals that itemize each line item. MSPs offering IT solutions on top of Azure should expect to achieve gross margins in the 40%-60% range on offers that can range from $50 to hundreds of dollars per user/month in price to the customer.

By now you’re probably asking yourself, “if productizing MSP services is so great why isn’t everyone doing it?” Well… it’s hard. You need to have a good understanding of your audience, your service delivery capabilities, and your risk tolerance. You will need to go through a rigorous trade-off process to decide not only what to include in each package, but more importantly, what to exclude.

The goal of this article is to help you identify these decision points and provide you with the tools needed to arrive at a productized Azure offering that’s right for your MSP practice.

We would be remiss in not mentioning some of the trade-offs that come with productization. By putting services and technologies in bundles, you do give up some flexibility. With custom services, every engagement can be a perfect fit for every customer. With productized, packaged offers, customers are bound to get some things that they may not need (just think of some apps included in Office 365 you never use) and not be able to get some of the things they may want without upgrading to the next tier.

It may be tempting to make exceptions and create one-off, custom solutions for customers to meet their precise needs. However, if you do this too much, the value of productization is diminished and you’re back to where you started. It is important to be comfortable with sometimes saying “no” and sticking to your standardized offering. If you’re doing this too often, it may be a sign your packaging isn’t quite right just yet and needs to be tweaked. However, if your standard packages meet the needs of your customers without significant customization 80% of the time, saying “no” 20% of the time may be well worth it.

A case study example: HeadInTheCloud Services, Inc.

Before delving into the specifics of designing your Azure offers, let’s address some critical success factors and questions you must answer to structure your offer, including:

- What should be included in the Azure offer?

- How many service categories should there be?

- How many plans should be in each category?

- How to decide if a specific feature should be part of a bundle or serve as an add-on?

- How to price each plan?

- How to lay out the offer and present it to customers?

To illustrate this, we will work with a fictitious MSP called HeadInTheCloud Services, Inc. (HTCS, for short).

HTCS is a full-service MSP with ten years of operational experience installing on-prem servers and networking, configuring Windows environments, setting up Exchange servers, migrating customers to Office 365, and managing customers’ security stack including AV, firewalls, and content filtering. HTCS offers help desk and Virtual CIO services, uses an RMM, and manages customers remotely as well as onsite. The customer base consists of 75 managed services customers and a few dozen break-fix customers who occasionally call HTCS for help with one-off projects.

Bill, HTCS’ founder and President, decided that he wants to modernize HTCS and migrate most or all of his managed services customers to Azure and Office 365 over the next five years. Bill wants to leverage as many services as possible in Azure and migrate customers’ data, servers, line-of-business applications, messaging and even virtualize their desktops in Azure. The goal is to leave as few items on-premises as possible and become a true Azure MSP. He learned as much as he could about building an Azure practice and had his engineering team go through technical training. HTCS became a CSP Reseller and understands how to optimize Azure consumption to maximize margins.

HTCS has two salespeople. They are somewhat technical, but rely heavily on Jim, the Senior Engineer at HTCS. Jim is also playing the role of a Sales Engineer and Cloud Solution Architect. At every customer engagement, when the discussion turns to Azure, the salespeople do a good job getting the prospects interested and asking for a quote.

But then they bring in Jim, who needs to understand the customer’s current environment, architect a comparable Azure environment, and price it. This architecture and the cost are then presented to the customer by the salespeople and there are inevitable changes, causing lots of back-and-forth with Jim having to re-architect and re-price the environment. Suffice it to say, the sales process is less than efficient and sometimes takes weeks to finalize an architecture and price for the customer to consider.

Bill wants to leverage HTCS’ existing customer base to come up with standardized Azure IT offer to enable his salespeople to present to all customers, especially when their contract is up for renewal or hardware is due for a refresh. Bill decided to call his offer IT-as-a-Service (ITaaS) and wants it to be an all-inclusive solution that’s easy to sell, sticky with his customers, and provides HTCS with strong margin (40%+).

Should Azure consumption be bundled or not?

The first question Bill needs to answer is whether or not to bundle Azure consumption costs with HTCS’ managed services or allow the customer to buy Azure independently (unbundled). Azure is a consumption-based public cloud, which can be quite challenging to quote accurately, and Bill is concerned that he may not be able to precisely predict the cost of Azure consumption for a particular customer on a monthly basis.

Bill has two options to consider:

Option 1: Azure consumption is not bundled with the offering

Let the customer bring their own Azure subscription, or sell the customer a CSP Azure subscription but bill for it separately from any other services that HTCS offers. This would be pass-through billing where HTCS will provide each customer with a monthly Azure usage report showing how much was consumed in the prior month. There are pros and cons to this approach.

Pros:

- Low risk to HTCS – the customer only pays for what they consume.

- HTCS will make a small margin on Azure consumption, which will be the CSP discount.

Cons:

- Customer may not be happy carrying Azure consumption risk and will likely expect HTCS, being the IT experts, to carry this risk.

- HTCS is making a low margin (typically <10%) on a significant amount of monthly spend.

- Billing will have to be done in arrears and will need to be reconciled with CSP billing. It won’t be possible to charge for Azure upfront at the beginning of the month: only at the end once the actual consumption is known.

- Customer will want to know precisely what the costs are going to be, which means Jim will have to get involved with every opportunity to scope, architect, and price it.

Option 2: Azure consumption is bundled with the offering

HTCS will include the cost of Azure infrastructure as part of their ongoing managed services cost and will not pass-through the actual consumption costs to the customer. Customers will be paying for HTCS’ services based on a value metric that’s independent of Azure infrastructure (e.g. per-user, per-endpoint, fixed monthly fee, etc.).

Pros:

- The customer will benefit from an easy-to-understand pricing structure and HTCS will benefit from a simplified way of explaining and selling a managed service with Azure bundled in. The customer will also have an easier time budgeting for changes, such as increases in number of users.

- HTCS will be able to charge an Azure management fee and bake it into the overall bundle price, thus increasing profit margins from <10% with a CSP discount to something significantly higher.

- HTCS can bill for the entire managed service at the beginning of the month and not have to wait until the Azure consumption bill has been finalized. This will allow HTCS to collect a full 30 days sooner and have the money on hand when the Azure bill comes due.

- If bundle pricing is well calibrated and there is enough margin to absorb any fluctuations, the quoting process will be much simpler. There may not even be a need to get Jim involved with every opportunity.

- HTCS can take advantage of all Azure margin optimization best practices, including Reserved Instances, Software Subscriptions, and auto-scaling to maximize its margin while charging the customer Azure list prices without any markup.

- Customer billing process will be much simpler without the need to provide the entire Azure consumption reconciliation report and try to explain each line item every month. When Azure is bundled in, it is not itemized.

Cons:

- HTCS is carrying the risk that Azure costs may exceed what was budgeted.

- If customer needs to increase the cost of Azure infrastructure, HTCS will have to go back to the customer and adjust pricing.

Bill decides to take on some risk in exchange for simplicity and higher margins and bundles Azure with his managed services.

How many service categories and how many plans are there in each?

Given HTCS’ extensive services portfolio, Bill is trying to decide how many categories of services should be part of HTCS’ Azure ITaaS offer. Having more categories allows HTCS to showcase more of its capabilities and create many revenue streams. On the other hand, each category of services increases the number of decisions a prospective customer has to make before becoming HTCS’ customer. Bill decides that there should be no more than five categories to strike a healthy balance between these two competing objectives.

Service categories

HTCS decides to have the following service categories:

- Managed Services and per-user security items

- Azure infrastructure

- Office 365 licensing

- End-user help desk

- Add-ons

Within each service category, Bill decides to keep the number of plans to a minimum to make the decision process easier for the prospect and his salespeople while still providing enough choice for each customer to get exactly what they need.

Each category will have three plans. Let’s see what Bill came up with.

Managed Services and per-user security items (60%–80% gross margin)

This is the money-making category. HTCS is an experienced MSP and is quite familiar with providing significant customer value through proactive IT services, automated monitoring, and remote remediation. Today, HTCS prices its managed services on a per-user basis. With its new IT-as-a-Service Azure offering, HTCS would like to continue offering managed services with their existing RMM, given the significant investment that has already been made into the RMM product. After all, Azure VMs are just like on-premises VMs and need to be closely monitored and maintained.

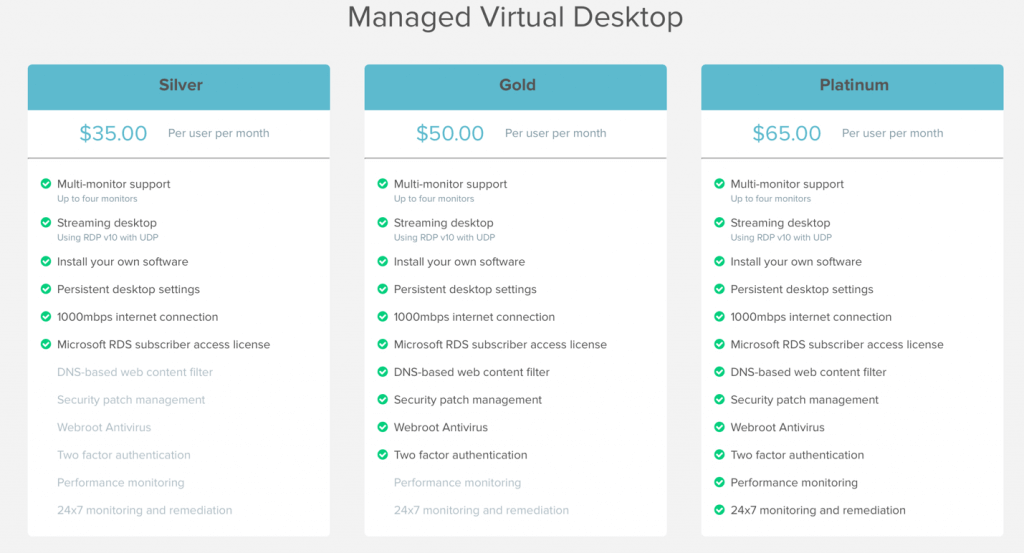

HTCS’ Azure ITaaS offering will be virtual desktop-centric, so Bill decides to call the service category “Managed Virtual Desktop” and creates three plans: Silver, Gold, and Platinum.

Here is what Bill decides to include in each Managed Virtual Desktop plan:

Each plan includes base functionality such as multi-monitor support and RDS licenses. Security services (e.g. Webroot AV, MFA, patch management) are added in the more premium plans, and Performance and 24×7 Monitoring is available in the top-tier plan.

Bill knows that with a good/better/best type plan structure, the best-practice is to choose the middle plan (Gold in this case) to be his desired outcome and to design the two edge plans (Silver and Platinum) to showcase the amount of value included in the preferred plan (Gold) to customers.

By bundling together multiple valuable managed services, HTCS is budgeting to capture 60% to 80% gross margin of the managed service price when it is sold as part of the comprehensive Azure ITaaS offer.

Azure Infrastructure (20%–50% gross margin)

Bill decides to once again create three Azure infrastructure packages to fit his customers’ needs. He considered bundling Azure with the Managed Virtual Desktop plans, but after reviewing multiple existing customer accounts, he discovered that HTCS would lose significant flexibility in being able to tailor each customer’s account to their exact needs. Bill also considered selling Azure in an “unbundled” fashion by passing the actual cost down to the customer but decided against this due to the billing complexity and margin pressure that HTCS would be subject to.

Bill came up with the following three packages that would meet the needs of 80% of his current and prospective customers, and left open the possibility for HTCS to create custom Azure infrastructure packages for individual customers as the need arose. Bill built in a bit of margin into the Azure infrastructure packages in addition to the standard discounts provided by HTCS’ CSP provider. He also intends to take full advantage of other Azure margin optimization levers such as reservations, software subscriptions, and auto-scaling.

By reselling Azure infrastructure in a bundle and charging a modest fee for infrastructure monitoring and management, HTCS is budgeting to capture 20% to 50% in gross margin for this service category when included with other components of the Azure ITaaS offering.

Office 365 licensing (10%–15% gross margin)

As is the case with many MSPs, Office 365 is the most popular SaaS application that HTCS resells and supports. Almost all existing customers have been migrated from on-premises Exchange servers to Office 365 and many are leveraging Teams, SharePoint, OneDrive, and other Office 365 suite applications.

The challenge with reselling Office 365 licenses is the publicly available list prices and customers’ expectation that it will be sold at or below list price. Office 365 is certainly a key component of HTCS’ ITaaS offer as it is the messaging and collaboration platform and a mechanism for licensing the Office suite, but it is not going to be a high margin line item.

Bill decides to limit the published Office 365 plans to the three most common ones, used by 80% of his customers. HTCS will continue selling all other Office 365 and Microsoft 365 products but for the purpose of designing and presenting the Azure ITaaS offer, these three are likely going to be enough.

Because of Office 365’s popularity and well-known pricing, HTCS expects to capture only 10% to 15% margin, which represents the discount provided by the CSP Provider. However, this is not an issue since significant margin to cover the administration of Office 365 and other per-user services has been included in the Managed Virtual Desktop service.

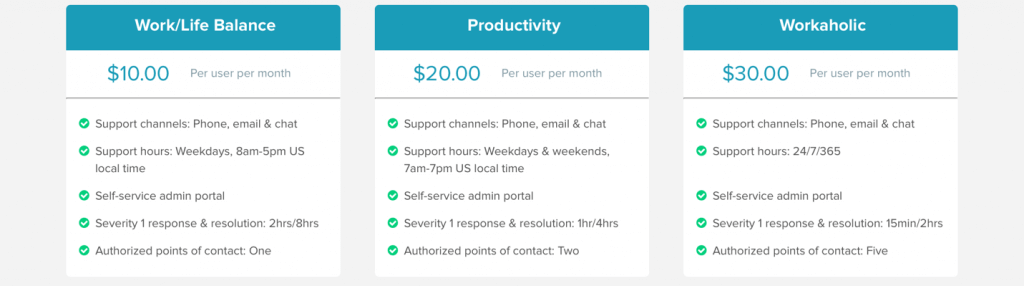

End-user help desk (10%–20% gross margin)

Like most MSPs, HTCS provides its customers’ end-users with help desk services for their day-to-day computer work, troubleshooting local and mobile devices, and being available after-hours, when needed.

Traditionally, HTCS bundled help desk into their overall managed services offering, but in the process of designing the Azure ITaaS offer realized that the needs of their customers varied based on an organization’s hours of operation and available in-house IT support.

Therefore, Bill decides to unbundle help desk from the rest of the managed services to allow a more precise match of services for the customer’s needs. Bill created three help desk plans segmented by availability of support (business hours only, long hours on weekdays, and 24/7), SLA expectations (i.e., first response and resolution), and number of authorized points of contact who can escalate issues directly to Tier 2 support.

Providing end-user help desk support is highly labor-intensive, especially when the SLA expectations are high, and support is needed outside of regular business hours. However, it is often a non-negotiable necessity for an MSP and it had to be made available as part of the Azure ITaaS offer.

HTCS has priced its end-user help desk support package with very modest 10% to 20% gross margin targets as a high support price can turn off a prospect from the entire engagement since they think they’ll rarely need it and are hesitant to pay much for it up-front.

Add-Oons (gross margin varies)

HTCS offers many services and technologies to their customers and are planning to continue to do so. However, for the sake of keeping the sales process for the Azure ITaaS offer as streamlined as possible, only the most popular add-ons were selected to be included in the basic offer.

The add-ons portion of the Azure ITaaS offer is designed to showcase certain services that are commonly purchased together with the rest of the virtual desktop-centric IT environment. These include one-time projects such as onboarding and migration, ongoing Virtual CIO strategic services, and popular licenses like SQL Server.

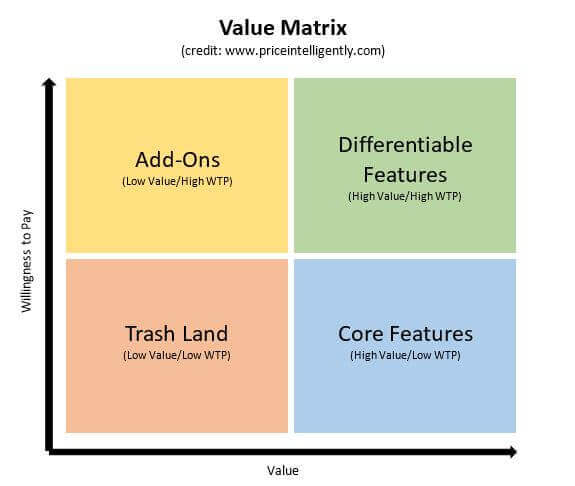

How do you decide if a specific feature should be part of a bundle or be an add-on?

To decide what features should be included within each of the service categories of the proposed Azure ITaaS offer, Bill utilized the Value Matrix model created by Price Intelligently (experts in SaaS pricing).

Each potential feature is evaluated along two axes: the value it delivers to the customer and the customer’s willingness to pay for the feature. This type of analysis is typically done as part of large-scale pricing study, but can be done qualitatively for any MSP who understands their customers’ needs.

- Core Features – these are features without which you can’t really have a credible offer. These features are table-stakes. Customers expect them from any MSP they would consider hiring and therefore don’t see them as differentiators. They may be quite valuable, but customers aren’t willing to pay much for them without a lot of convincing and selling. For MSPs, examples of Core Features may include:

- End-user help desk

- Remote monitoring and management

- Office 365 implementation

- Differentiable Features – these features are both highly valuable and benefit from customers’ high willingness to pay for them. They are items that differentiate one MSP from another and showcase a particular MSP’s expertise in a certain technology, methodology, or industry vertical. It is ideal to have a few differentiable features in each Plan. For MSPs, examples of Differentiable Features may include:

- Virtual Desktop management expertise

- Azure expertise

- Financial services, non-profit, or any other vertical specialization

- Trash Land – these are service components that are both low value and as a result have low customer willingness to pay. When designing an offer, it is best to reduce or eliminate the number of such features, as they don’t help capture value (via gross margin), yet cost money for the MSP to deliver. For MSPs, an example of a Trash Land item is the resale of Office 365, AntiVirus, or backup without any value-added features on top of the software license. The customer can purchase the licenses in any number of channels and if the MSP is not providing value on top of the license, these should not be included in a well-designed Azure ITaaS offer.

- Add-ons – customers may not place much value in these features, but a select few, are very important. Such features shouldn’t be included as a part of the standard offer but should instead be made available as an add-on to a core offering. For MSPs, example of Add-ons may include:

- Hot-site DR for financial services customers or others with specific regulatory requirements

- Ongoing Virtual CIO services for companies without any in-house IT expertise to help guide the long-term IT strategy

- Special licenses like SQL Server for those organizations with line-of-business apps requiring SQL

It is important to remember that features move around the four quadrants of the Value Matrix over time. Something that starts out as a differentiated feature may eventually become a core feature, or even move to Trash Land. Add-ons that may be applicable to only a select customer segment may become popular and eventually become a core feature. Therefore, every couple of years the plans and packages must be reviewed to ensure the proper feature mix.

When designing individual plans for the Azure ITaaS offer, Bill created a list for each possible feature in all categories and then evaluated them based on the diagram above. Core features were made a part of all plans, differentiated features were used to clearly distinguish between individual plans, Trash Land features were kept to a minimum, and add-ons were used to make unique features available as separate items with a healthy gross margin.

How to price each plan

Pricing subscription services is far from trivial. The most accurate approach is to conduct a large-scale pricing study surveying thousands of customers across a broad spectrum of features, packages and their willingness to pay for each combination. Such pricing studies tend to be very expensive ($100K+) and are unlikely to be conducted by too many MSPs. However, the typical services offered by MSPs are largely consistent across geographies and industries and it is possible to get a pretty good idea of a customer’s willingness to pay based on an MSP’s experience selling such services to dozens or hundreds of customers.

The major takeaways from Nerdio’s pricing study of thousands of SMB customers include:

- A willingness to pay for an all-inclusive package (infrastructure, software, and services) of cloud IT services ranges from $100 to $250 per user per month

- Larger companies tend to be willing to pay more per user than very small companies

- Companies in highly regulated industries (i.e., healthcare, financial services, legal, etc.) tend to be willing to pay more per user

Understanding a customer’s willingness to pay at certain price points and with specific pieces of functionality is helpful in designing a complete Azure ITaaS offer and splitting the complete offer into prices of individual components. For instance, the sum-total of all “lower end” plans in an Azure ITaaS offer should add up to roughly $100/user/month, while the sum of all “higher end” plans should add up to about $250/user/month.

How to package your offer and present it to customers

Having gone through the above exercise, Bill needs a way to pull all the information together to present it to his team and eventually prospective customers. Fortunately, Nerdio’s Plans Designer functionality has been created for just this reason.

It is a fully functional Azure ITaaS pricing page creator that allows MSPs to design their own packages with customer plans, features, and prices and then publish the entire offer as a “Pricing Page” on their own website with custom branding, colors, and images.

The Pricing Page serves as a selling tool for the sales team to review Azure ITaaS options with customers and a lead generation tool for anonymous website visitors who want to price out their own Azure ITaaS solutions.

We hope this article and case study proved to be helpful for you. We will continue to update this page as more Azure packaging information comes to market.